Further to the Corus press statement of November 2008, Corus and Klesch have today announced that they have signed a Share Purchase Agreement (SPA) for the acquisition of Corus’ aluminium smelters by Briand Investments B.V., an affiliate of Klesch.

The signing follows completion of the internal consultation and advice process and the receipt of necessary regulatory clearances. Completion of the transaction remains subject to certain conditions being fulfilled by both parties.

End

For further information on Corus please call Bob Jones, Tel: +44 (0)207 717 4532

For further information on Klesch & Company please call A. Gary Klesch, Tel. +44 (0)207 493 4300

Notes

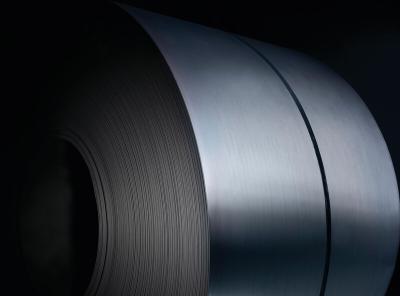

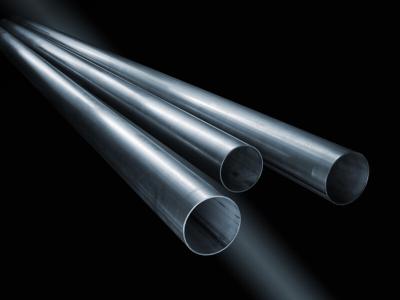

Corus is Europe's second largest steel producer with annual revenues of more than £12 billion and crude steel production of about 20 million tonnes. With main steelmaking operations primarily in the UK and the Netherlands, Corus supplies steel and related services to the construction, automotive, packaging, mechanical engineering and other markets worldwide. Corus is a subsidiary of Tata Steel, one of the world’s top ten steel producers. Following the acquisition of Corus in 2007, the combined enterprise has an aggregate crude steel capacity of more than 28 million tonnes and approximately 82,700 employees across four continents.

Klesch & Company, founded in 1990 and headquartered in London, England is an investment group which makes control equity investments across various industries, in particular oil, gas, transportation, electricity, aluminium and other base metals. Associated companies of Klesch & Company own Zeeland Aluminium Company in Vlissingen, the Netherlands, which produces 260,000 tonnes of primary aluminium metal per annum.

Associated investment interests of Klesch & Company are also currently building a 725,000 tonnes primary aluminium smelter in Libya.