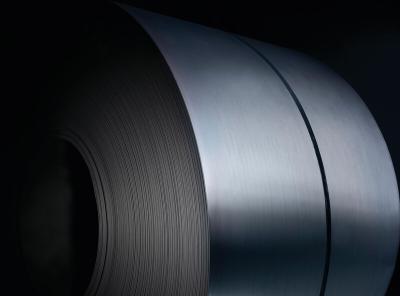

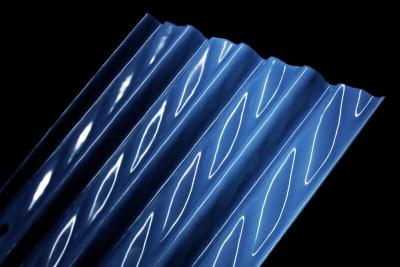

Tata Steel Limited and thyssenkrupp AG have signed a Memorandum of Understanding to create a leading European steel enterprise by combining the flat steel businesses of the two companies in Europe and the steel mill services of the thyssenkrupp group. The proposed 50:50 joint venture – thyssenkrupp Tata Steel – would be focused on quality and technology leadership, and the supply of premium and differentiated products to customers, with annual shipments of about 21 million tonnes of flat steel products.

The joint venture would have a pro forma turnover of about €15 billion per annum (Rs 115,000 crore) and currently employs about 48,000 people spread across various locations. It would be headquartered in the Amsterdam region of the Netherlands. The proposed combination of businesses would be formed through a non-cash transaction framework, based on fair valuation where both shareholders would contribute debt and liabilities to achieve an equal shareholding in the venture.

thyssenkrupp Tata Steel would have a robust capital structure that is well matched by the underlying free cash flows of the company. It would benefit from the scale and distribution network capability of the combined assets to achieve quality, technology and cost leadership in the European steel industry. It is also the clear intent of both partners to remain as long term investors and continue the present network configuration of all the upstream hubs in the proposed joint venture company.

Commenting on the MoU, Mr. N Chandrasekaran, Chairman, Tata Steel said: “The Tata Group and thyssenkrupp have a strong heritage in the global steel industry and share similar culture and values. This partnership is a momentous occasion for both partners, who will focus on building a strong European steel enterprise. The strategic logic of the proposed joint venture in Europe is based on very strong fundamentals and I am confident that thyssenkrupp Tata Steel will have a great future.”

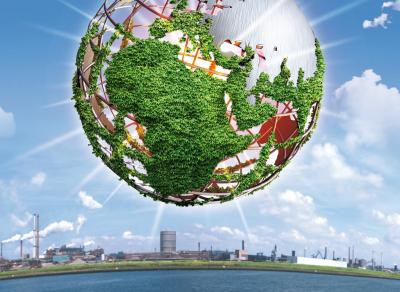

“thyssenkrupp and Tata Steel are creating a sustainable future for their respective European steel activities by jointly forming the planned joint venture. This business combination creates a strong number 2 and is thus much better positioned to cope with the structural challenges in the European steel industry. With Tata Steel, we have found a partner with a very good strategic and cultural fit. Beyond a clear performance orientation, we also share the same philosophy of corporate responsibility towards employees and society”, said Dr. Heinrich Hiesinger, Chairman, Executive Board, thyssenkrupp.

Mr. Chandrasekaran added: “As our partnership with thyssenkrupp progresses in Europe, Tata Steel is well positioned to leverage India’s growing economy by adding significant capacity in value added products to meet emerging customer needs. Tata Sons would continue to financially support Tata Steel’s strategy for capacity expansion through organic and inorganic growth opportunities in India.”

Mr. Koushik Chatterjee, Group Executive Director, Tata Steel, said “The signing of the MoU with thyssenkrupp marks an important milestone for Tata Steel Group with regard to wider European portfolio strategy. Based on our initial assessment, cost synergies in the range of €400 to €600 million per annum may be realised through integration of commercial functions, R&D and other supporting activities. Both shareholders have taken care to ensure that the balance sheet of the combined venture will be structured to ensure a sustainable business going forward. The proposed transaction in Europe also paves the way for significant de-leveraging of the Tata Steel Group’s consolidated balance sheet and provides the platform for Tata Steel to pursue future growth.”

Through the combination, both companies would benefit from significant synergies. In the early years, these synergies would primarily derive from an integration of sales and administration, research and development, a joint optimisation of procurement, logistics and service centers. In addition to this, thyssenkrupp Tata Steel would seek to improve capacity utilisation of the network across the three hubs of IJmuiden (Netherlands), Duisburg (Germany) and Port Talbot (Wales, UK) and their related downstream facilities.

The process will now move to the next phase in the transaction with due diligence and negotiations on the definitive detailed agreements. The combination is subject to execution of the final agreements and obtaining all corporate authorisations, including Board and Tata Steel shareholder approvals. Completion would be conditional on certain closing conditions, including obtaining requisite competition approvals.

About Tata Steel

Tata Steel Group is among the top global steel companies with an annual crude steel capacity of 27.5 million tonnes per annum (MTPA) as on March 31, 2017. It is the world's second-most geographically-diversified steel producer, with operations in 26 countries and a commercial presence in over 50 countries. The Group recorded a consolidated turnover of US $18.12 billion (INR 117,420 crore) in FY17. Tata Steel Group is spread across five continents with an employee base of nearly 74,000. Having bagged the Deming Application Prize and Deming Grand Prize for continuous improvement in 2008 and 2012 respectively, Tata Steel has now been recognised as the global ‘Industry Leader’ in ‘Steel category’ by Dow Jones Sustainability Index (2015). Besides being a member of the World Steel Climate Action Programme, Tata Steel has also been felicitated with several awards including the Prime Minister’s Trophy for the best performing integrated steel plant for 2013-14 (received in 2017), Best Risk Management by CNBC TV18 (2016), ‘Best-in-class Manufacturing’ award from TIME India (2016) and the ‘Most Ethical Company’ award from the Ethisphere Institute (2016), IIM Sustainability Award (2015), among several others.

Disclaimer

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.