There has been considerable media coverage and speculation on social media following Tata Steel’s announcement on Friday 19th January, where the company set out proposals to transform and restructure its UK business.

Following the high volume of questions and enquiries received, Tata Steel UK has created a set of FAQs to put all the information in one place. This should provide a useful starting point – if you have any further queries, please get in touch with our contacts at the bottom of the page.

Steel sovereignty

Question 1: Is steel made from EAFs an equal replacement for ‘virgin’/ primary steel? Does the UK leave itself vulnerable by abandoning its ‘virgin’/ primary steel capacity?

Answer: When iron-making furnaces were first built in Port Talbot, they could be supplied with locally produced iron ore and coal. Making ‘virgin’/ primary steel in Port Talbot today means importing millions of tonnes of iron ore and coal from around the world to feed the blast furnaces. More than 90% of these raw materials are imported from a small number of suppliers in countries as far away as Japan, Brazil and Australia.

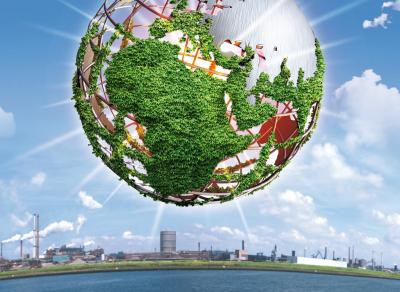

In the coming years, the UK’s abundant supply of steel scrap and increasing levels of renewable electricity will be able to feed and power Tata Steel’s proposed electric arc furnace. This means our domestic self-sufficiency would increase – from just 10% of UK-sourced raw materials today to about three-quarters with an electric arc furnace, making our steel production more resilient to adverse global events and supply chain risks.

The resilience and sovereignty of the overall UK steel industry would also be significantly enhanced through this transition. We plan to make good use of the country’s strong scrap supply resources, align with the country’s renewable energy ambitions and position ourselves at the forefront of the global supply of green steel from a globally-competitive UK industry.

Tata Steel has also made clear that, with the right investment and policy environment, it is open to further investment, such as in a direct reduced iron (DRI) plant. We would look at the case for a potential DRI plant in the UK if the business conditions are right and, if in future, the Government supported further investment.

Question 2: Why has Tata Steel chosen EAF technology over a DRI plant with the capability to produce ‘virgin’ steel from iron ore?

Answer: Our proposal to invest in an electric arc furnace (EAF) mirrors the successful installation of this low-carbon technology in other major steel-producing markets such as the United States, where emissions have been cut while guaranteeing production of complex, high-quality steel. More than 70% of steelmaking in the United States is now EAF-based. In Europe this figure is 40% and expected to rise sharply in the coming years as steelmakers make the switch from blast furnaces to electric arc furnaces.

But our focus on EAF technology would not be the end of our decarbonisation transformation in the UK. In fact, the installation of an electric arc furnace should be seen as part of the future transformation of Port Talbot in which a DRI plant could be added, provided there was financial support available and the business conditions were right (e.g. having access to competitively-priced natural gas and then green hydrogen, which is not the case currently).

Question 3: Could a direct reduced iron (DRI) plant could replace the jobs lost from Port Talbot’s heavy end?

Answer: DRI, or similar HBI (hot briquetted iron), plants around the world do not employ the same number of jobs as a steelworks’ heavy end. They typically employ around 200 people.

For example, voestalpine created 190 jobs at this Texas plant which can produce 2 million tonnes of HBI by reducing iron ore. HBI, like DRI, is used in electric arc furnaces.

Steelmaking capabilities

Question 4: Is EAF-produced steel a lower quality than blast furnace-produced steel? Won’t this mean that Tata Steel UK will not be able to make the same products for customers?

Answer: EAF technology can already make 90% of the grades of steel which blast furnaces can. Adding an iron source to the scrap in the EAF – i.e. direct reduced iron, hot briquetted iron or pig iron – would enable us to manufacture the most demanding steel products for customers.

The United States has arguably led the way in developing ways to produce more complex grades of steels using EAFs so they can be used in some of the most demanding end uses, including in the automotive industry. Automotive and packaging companies are already buying flat steel products made in electric arc furnaces.

As part of Tata Steel’s investment in the UK, we are looking to establish two new Centres for Innovation at the University of Manchester and Imperial College London. Working with world-leading academia, this multi-million pound investment will help us develop advanced materials for our customers. It would also complement R&D we are already doing at the University of Warwick and Swansea University.

With additional R&D, supply chain collaboration, and development of the UK’s scrap supply chain we firmly believe we’ll be able to supply the full order book by the time our proposed electric arc furnace comes onstream.

Funding

Question 5: Is the Government' funding jobs cuts at Port Talbot?

Answer: The Government funding is helping to secure 5,000 jobs at Tata Steel in the UK.

We want to build a business here in the UK which is both environmentally and financially sustainable. In order to do that, we need to address two key issues: our significant financial losses and the fact we are the country’s largest CO₂ emitter. We need to restructure the business now to enable us to be able to invest, jointly with government, in a new electric arc furnace and upgrade other assets.

No government would be able, or willing, to cover our financial losses. Instead, the UK Government plans to invest in green steelmaking technology at Port Talbot with money paid only as the project progresses. We won’t receive anything until we actually start building the proposed new electric arc furnace.

Question 6: Could the company wait for a possible Labour government who would invest more via its £3 billion green steel fund?

Answer: It’s important to recognise that Tata Steel UK is losing more than £1 million a day, so there’s an urgent need to ensure the business is operationally and financially sustainable.

Governments can support investment in new technology, but they are not allowed under state aid rules to cover steel companies’ financial losses. That means any financial losses have to be paid by Tata Steel, which is now unaffordable.

Tata Steel has, though, made clear it is open to further investment in the future, such as through a direct reduced iron (DRI) plant, but we need to develop a settled EAF-based configuration first. We would look at the case for a potential DRI plant if the business conditions are right.

Company finances

Question 7: Tata Steel UK is reportedly losing £1 million a day. How can Tata Steel UK still be operating if it’s been making losses for so many years?

Answer: The directors of Tata Steel UK have a legal duty to prepare annual accounts which give a true and fair view of the assets, liabilities and financial position of the company. PWC, an independent auditor, then inspects our accounts, like they do with other companies, to ensure they're correct and comply with the law. Our financial accounts are available for anyone to see on the UK’s Companies House website. Our parent company, Tata Steel Limited, is publicly-listed in India with more than a million shareholders who effectively own it. It also publishes its financial results every three months, which include the UK business figures.

Those accounts show that since 2007, Tata Steel UK has lost more than £4 billion after tax. The business has only been able to keep going because our parent company in India has provided the necessary financial support. Without continued parental support, Tata Steel UK would not be able to carry on trading.

With ageing assets, the UK losses in 2023 got even worse. In the past three months, we lost almost £160 million (EBITDA) – about £1.7 million a day. That’s clearly not sustainable.

Question 8: Tata Steel UK’s parent company, Tata Steel Limited, makes good profits. Why can’t they give more money to its UK business?

Answer: Tata Steel Limited, like any public company, is accountable to its shareholders who reasonably expect to receive a return on their investment.

Tata Steel has been an incredibly patient investor in our UK business since it acquired Corus in 2007. It has invested £4.7 billion here in the UK, but has not earned either profits or received a single penny in dividends in return. It was also compelled to write off the entire amount of its investment in the UK business.

Despite these losses and having to write off its investment in the UK, Tata Steel is still proposing to invest £750 million in electric arc furnace technology and asset upgrades to secure long-term, high-quality steel production in Port Talbot. It will also provide more than £150 million for a comprehensive support package for affected employees, community programmes, skills training and job-seeking initiatives, including through the Transition Board. Additionally, the company will continue to provide significant funding to cover expected cash losses for the UK business during the proposed transition.

Decarbonisation

Question 9: Are jobs at Port Talbot being sacrificed in the pursuit of net-zero goals?

Answer: We want to build a business here in the UK which is both environmentally and financially sustainable. In order to do that, we need to address two key issues: our significant financial losses and the fact we are the country’s largest CO₂ emitter.

The proposal to invest in electric arc furnace technology follows a comprehensive analysis into all the financial and technological options available for us. The transition mirrors the successful installation of EAFs in other major steel-producing markets such as the United States, where it has cut emissions whilst guaranteeing production of complex, high quality steel. On completion, the programme would transform the competitiveness of our UK business, secure most of our capability in terms of end products, whilst cutting our carbon emissions by about 85%.

Consumers’ expectations are changing – they are demanding more sustainable products with a lower carbon footprint. Industry needs to change to meet those expectations. The demand for green steel is increasing while governments in advanced economies, like the UK and EU, are pushing industry to reduce emissions by increasing the cost of polluting. Currently, Tata Steel UK pays carbon costs of £70 - £80 million a year for operating its blast furnaces, with significantly higher costs expected over the coming years. It’s not an option to continue with the status quo and if we don’t act to dramatically reduce our CO₂ emissions, we will be out of business.

It is true an EAF-based operation requires fewer people to run it because we would not need coke ovens, a sinter plant, blast furnaces or a steel plant. But operating an EAF would give us the opportunity to invest further in other assets in the future and for Port Talbot to be at the centre of a green hub which attracts other investments and new jobs – everything from building offshore wind turbines to making low-carbon jet fuel.

We will continue to play a leading role in the creation of the Celtic Freeport to develop the huge investment and job opportunities which the transition to a green economy offers.

Question 10: Isn’t it less environmentally friendly for Tata Steel to import steel during the transition period rather than making steel in the UK?

Answer: We would need to import steel substrates (slab and coil) for a temporary period of time while the electric arc furnace is being built, but we do not expect this to lead to higher carbon emissions. Many of these steel imports would come from our sister plants in India and the Netherlands. Our plants in India have similar CO2 footprints as Port Talbot and our Dutch plant is one of the top three most CO2 efficient steel plants in the world with 15% lower carbon emissions than Port Talbot.

The environmental cost of shipping steel substrate will be less than shipping raw materials from around the world to Port Talbot – for every 1 million tonnes of steel slab or coil we import, we would save importing about 2.5 million tonnes of raw materials, as we currently do. The future model of using UK-sourced scrap in an EAF would also lead to a big drop in raw material imports.

For further information, please contact:

Tim Rutter, Head of PR, Tata Steel UK tim.rutter@tatasteeleurope.com +44 (0)7850 990755 or

Abi Thomas, PR & Social Media Specialist: abigail.thomas@tatasteeleurope.com

Press Office: ukpressoffice@tatasteeleurope.com

- The Tata Steel Group has been named one of the most ethical companies in the world, and is among the top producing global steel companies with an annual crude steel capacity of 34 million tonnes.

- Tata Steel in the UK has the ambition to produce net-zero steel by 2045 at the latest, and to have reduced 30% of its CO2 emissions by 2030.

- Tata Steel is the largest steelmaker in the UK with primary steelmaking at Port Talbot in South Wales supporting manufacturing and distribution operations at sites across Wales, England and Northern Ireland as well as Norway, Sweden, France and Germany. It also benefits from a network of international sales offices around the world.

- Tata Steel employs more than 8,000 people and has an annual crude steel capacity of 5 million tonnes, supplying high-quality steel products to demanding markets, including construction and infrastructure, automotive, packaging and engineering.

- Tata Steel Group is one of the world's most geographically-diversified steel producers, with operations and a commercial presence across the world.

Follow us on social media